The psychedelics industry is following in the same projectile footsteps of the cannabis industry and could be on its way to becoming a multi-billion dollar industry. With the potential to transform mental health treatments. Researchers from Johns Hopkins and other leading institutions have embraced advancements in psychedelic research which has spawned a growing list of science-based biotech companies focused on further clinical development.

Let’s take a look at how investors can add exposure to the psychedelics sector and add into their portfolio without having to purchase multiple companies and actively manage their portfolio.

Invest in a Psychedelics ETF’s

Exchange-traded funds, or ETFs, are one of the easiest ways for investors to build exposure to different corners of the market into their portfolios. They provide instant diversification to a particular theme with exposure to many different stocks in a single security. At the same time, passive ETFs are typically less expensive to own than actively managed mutual funds.

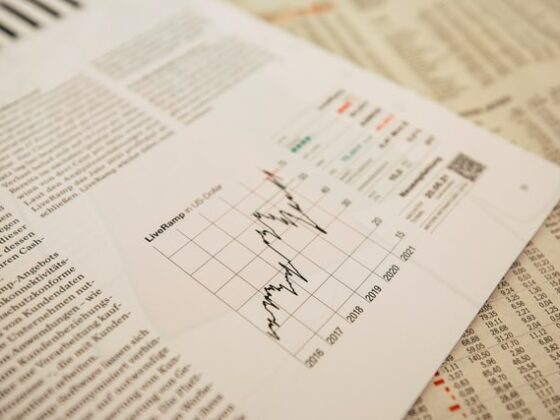

The Horizons Psychedelic Stock Index ETF (NEO: PSYK) became the first exchange-traded fund in Canada to focus on psychedelics with its launch in January. With exposure to 23 publicly traded psychedelics companies, a single share of the ETF provides broad exposure to the entire psychedelics industry with a modest 0.85% expense ratio.

The ETF’s largest holdings include Seelos Therapeutics Inc. (NASDAQ: SEEL) at 16.56%, Mind Medicine Inc. (NASDAQ: MMED) at 8.86% and Compass Pathways plc (NASDAQ: CMPS) at 8.5%. Aside from the popular psychedelics pure plays, the fund holds large and diversified companies like Johnson & Johnson Inc. (NYSE: JNJ) and AbbVie Inc. (NYSE: ABBV).

Many of these companies have been strong performers in recent weeks and months. For example, MindMed shares have more than doubled from less than $3.00 in mid-April to around $6.00 in recent sessions.

The downside of ETFs is that they involve a management fee that cuts into long-term returns. In addition, the composition of most ETF portfolios is based on a passive indexing algorithm that may not reflect an ideal composition for an individual investor—it may be overweight or underweight in certain areas that an investor wants exposure.

Invest in Diversified Companies

Many companies provide ETF-like exposure to a market while adding a dose of active management. The most popular example is Warren Buffett’s Berkshire Hathaway Inc. (NYSE: BRK.A), which owns everything from insurance companies to rail transportation companies. The advantage of these companies is the management team’s acumen.

Most psychedelic companies are focused on a particular area, such as specific clinical trials for anxiety, depression and PTSD, but some companies have embraced this kind of diversification.

For example, Delic Corp. (CSE: DELC) (OTC: DELCF) is building an ecosystem of media, mental health and science businesses focused on the nascent psychedelics industry and led by an all-star team.

Click Here: Download Delic’s Investor Presentation & Receive Updates

The company’s management team comes from the upper echelons of High Times, the iconic cannabis media brand, while its backers include names like Paul Rosen, who was a co-founder of PharmaCan Capital Corp. and served as its first President and CEO. With the right team in place, the company has begun to build its sprawling business.

After getting a start with a media presence, the company acquired Ketamine Infusion Centers, a business with 2 clinics and $1.5 million in revenue over the past three years. The company then acquired Complex Biotech Diversity Ventures (CBDV), a profitable business that provides both research services and a growing IP portfolio focusing on psilocybin and cannabis. Closing of the transactions are subject to customary conditions and are expected to close in the second quarter of 2021.

Looking Ahead

Investors have many different options when building exposure to psychedelics within their portfolio. Exchange-traded funds (ETFs) provide an easy way to access a wide array of exposure for your portfolio holdings of companies whereas companies like Delic Corp. (CSE: DELC) (OTC: DELCF) are focused on building their own diverse ecosystem under one roof with an exceptional management team.

For more information, visit the company’s website or download their investor presentation.

Disclaimer

The above article is sponsored content. CannabisFN.com and CFN Media, have been hired to create awareness. Please follow the link below to view our full disclosure outlining our compensation: http://www.cannabisfn.com/legal-disclaimer/

This article was published by CFN Enterprises Inc. (OTCQB: CNFN), owner and operator of CFN Media, the industry’s leading agency and digital financial media network dedicated to the burgeoning CBD and legal cannabis industries. Call +1 (833) 420-CNFN for more information.